Donate to the Catholic Education Foundation and get a 75% state tax credit.

The CEF Tax Credit Scholarship program allows any company that pays Kansas corporate income tax to redirect the amount of its Kansas tax liability (up to $500,000) to Catholic Education Foundation as a qualified charitable gift, and receive a 75% credit on its state income tax.

The tax credit is made possible through the Kansas Tax Credit for Low Income Student Scholarship Program. Up to $10 million in state tax credits are available each year on a first-come, first-served basis.

*Certain donation qualifications exist; please contact CEF's Tax Credit Office for details.

How can my company participate in the tax credit program?

Any company that pays Kansas income tax is eligible to participate, but different types of companies may benefit differently from the tax credits.

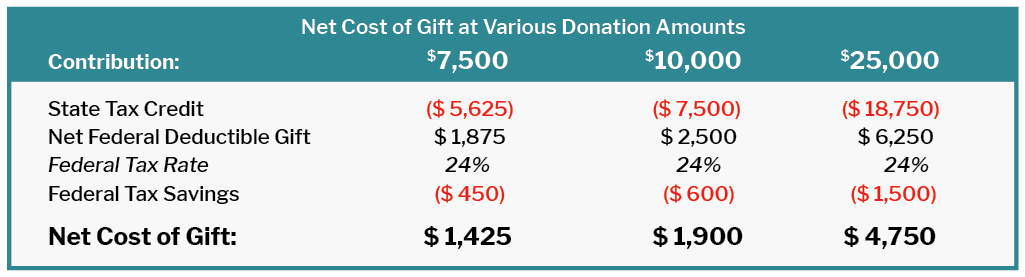

For example, a C-Corporation can eliminate or reduce its Kansas state income tax liability using the 75% tax credit, then may also treat the 75% credit amount of its contribution as an ordinary and necessary business expense for federal tax purposes. This company may also be able to take the remaining 25% as a possible charitable donation on its federal income tax return, depending on their specific circumstances.*

Pass-through corporate entities (such as S-Corporations and LLCs) which receive the 75% state income tax credit and apply it to their Kansas state income tax liability may not be eligible to treat the tax credit as a business expense. However, they may be able to treat the remaining portion (25% in examples shown) as a charitable donation, depending upon the specific taxpayer circumstances.* (The IRS has not issued a final regulation for pass-through entities.)

*Note: There are a number of taxpayer-specific factors that could impact these results. The Catholic Education Foundation does not provide tax, legal or accounting advice. Any illustrative material is prepared for information purposes only. Potential donors should consult their own tax, legal and accounting advisors.

*Note: There are a number of taxpayer-specific factors that could impact these results. The Catholic Education Foundation does not provide tax, legal or accounting advice. Any illustrative material is prepared for information purposes only. Potential donors should consult their own tax, legal and accounting advisors.

How will our contribution help our communities?

Your donation will be used to provide scholarships to eligible low-income children to attend K-12 Catholic schools. These students are the most economically challenged students in our communities, with average family incomes below $25,000 per year. Without these CEF scholarships, these students’ families would not have access to a quality, values-based Catholic education.

In addition to the tax advantages of your contribution, you’ll be investing in proven future workforce members for your community. Students who have been awarded these CEF scholarships graduate at a 100% rate, compared to 69% in their peers’ assigned neighborhood schools. A recent Pew Research study concluded that Catholic school students are also more likely to vote and volunteer in their communities, because they are taught to be ethical and productive members of society.

CEF is a 501(c)3 nonprofit organization and Kansas state-approved scholarship granting organization. This year, CEF awarded more than 300 scholarships through our Tax Credit scholarship program and more than 1,700 overall. Through all of our scholarship programs, CEF is saving the state of Kansas more than $24 million per year in educational expenses.

The Catholic Education Foundation is the only Archdiocesan charitable organization offering Kansas state income tax credits.

Get a tax credit for individuals

More about CEF tax credit scholarship program

KS Dept. of Revenue Low-Income Students Scholarship Tax Credit

2023 Kansas Income Tax Credits are available for a limited time. Please contact CEF or call (913) 647-0344.